Power your agency with Temporary Recruitment Software

Powerful temporary recruitment software to run your entire temp agency's recruitment operations from one command-and-control console. Gain visibility over temporary worker availability and shift scheduling, digital timesheets, and much more.

Recognised by leaders, loved by 22,000+ recruiters

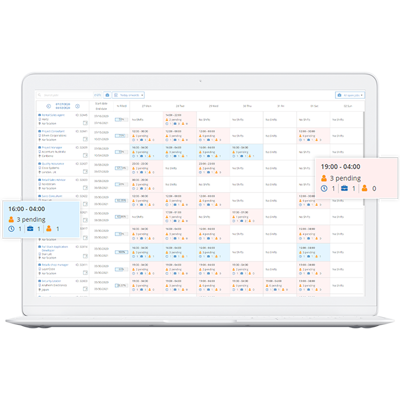

Manage & Search Availability

Send bulk availability requests and get updates of temporary candidates' availability in real-time. Search real-time availability right down to the minute.

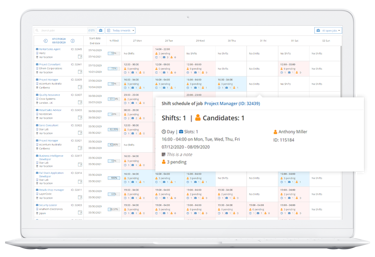

Schedule Shifts

Add new jobs and build rosters to match client requirements. Includes single, split and overtime shifts.

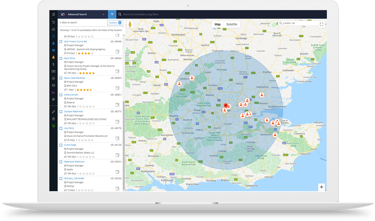

AI Automatch

Automatch temp workers to jobs in a single click.

Search for temps by exact location on a map view combined with availability & compliance requirements, based on client needs.

Want to see Vincere in action?

More features of our temporary staffing software

Send Booking Notices

Send candidate booking confirmations to clients along with verified pre-boarding and compliance documents

Compliance & Verification Checks

Recruitment compliance onboarding features allows you to create compliance forms and pre-boarding document packs for temporary workers to submit via an ESS portal.

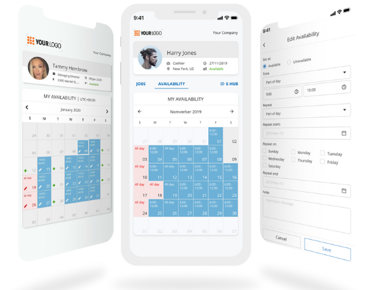

Time & Expenses

Workers get one streamlined, digital experience to submit time, leave & expense for approval.

All from an quick-to-use, slick recruitment mobile app, that makes you the easiest agency to work with.

DoorClock

Let workers clock in/out and track breaks, all from their mobile phone. Works great as a virtual receptionist to welcome visitors...and even better as part of your MSP offering.

Automate Timesheets & Invoicing

Approved timesheets auto-generate invoices ready for you to review and send Sales | Purchase | Credit invoices instantly. Multi-currency, down to x4 decimal places. Our invoicing features simplify your workflow.

Schedule Exports to Payroll

Customize fields for export and seamlessly connect your middle and back office. Do it once with our 'set-and-forget' export scheduler.

Real-time reports. Specifically for temporary recruitment.

The Holy Grail.

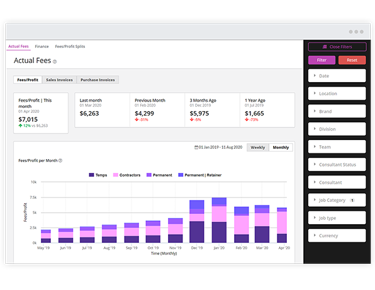

See revenue in real time

How much money are we really making?

- Fees/profit per month

- Fees/profit accumulative

- Drilldown by brand, team, division...down to consultant

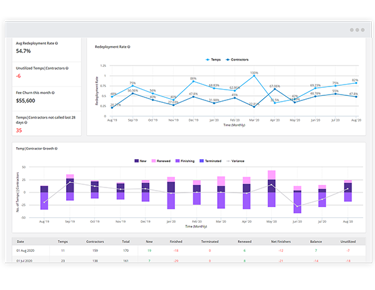

Enhanced redeployment analysis

Optimize deployment rates and maximize profits:

- See re-utilization rates in real-time.

- Drill down & deploy un-utilized temps

- Target consultants on redeployment % of workers

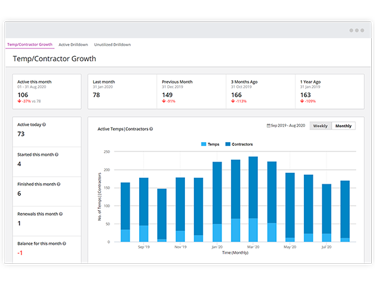

See the numbers to grow your business

Know your Temp business by the numbers:

- How many starters, finishers & renewals?

- How many are active right now?

- How about balances for the month?

How will Vincere help your business?

It integrates with your other applications

Integrate Vincere with the apps that you already love. Our partner marketplace shows you exactly what you can connect with.

You get excellent security

Vincere prioritises data privacy and security by implementing strict security measures.

You get first-class customer support

Our support hub and teams ensure a seamless experience for all our users, around the clock.

Temporary recruitment software FAQs

What is temporary working?

In brief, temporary working can be understood as the process of recruiting temporary and contract workers such as interns, freelancers, consultants, and temps. Demand for short-term workers has been increasing in a variety of industries - hospitality, engineering, and education, to name a few.

Compared to permanent work, temporary work comes with a lot more detailed and complicated requirements.

What is temporary recruitment software?

Temporary recruitment software provides an efficient tool to track, shortlist and book candidates or workers to jobs/shifts efficiently and quickly. By using temporary staffing software, recruiters are able to optimize the staffing process at a lower cost, in a shorter time with high volumes.

Who uses temporary employment software?

Both companies and employment agencies benefit from such software. The latter, however, make the most of it, as such a system helps them to identify, monitor, and recruit top talent for each position based on data-driven parameters. At the same time, it also allows recruiters to build strong relationships with potential candidates.

Why use temporary recruitment software?

A common challenge when it comes to running a temporary recruitment business is how to consistently find quality candidates in a short amount of time. With the help of a recruitment agency software, recruiters are capable of managing the recruiting process much more effectively - they can achieve their goals at the lowest cost and the shortest time possible.

How does temp agency software work?

Temp agency software streamlines the process of connecting businesses with temporary workers by managing candidate databases, job postings, and placement workflows. It automates tasks like scheduling, timesheet management, and payroll, ensuring efficient communication and compliance.

What are the benefits of temporary recruitment software?

Temp agency software drastically increases efficiency by automating time-consuming tasks like scheduling split shifts and bulk availability requests, saving both time and money. It streamlines candidate management by facilitating consistent communication and updates on relevant openings, fostering stronger candidate relationships. Finally, it automates key processes like onboarding, reporting, and payroll exports, optimizing the experience for both clients and candidates.